Latoya S. sits at the lady work desk searching through overdue costs. Since 1998, she actually is taken out near 20 short-term payday advances. Pic by Marlita A. Bevenue.

1 day final might, Latoya S. was walking this lady 6-year-old pit bull, Gucci, as he started initially to snarl excitedly at a strange guy sitting on the front deck of the woman stone, two-bedroom ranch home. As Latoya reached their homes, the man talked. a?You Latoya?a? She nodded.

The person arrived better because the pet’s bark became louder. The guy handed Latoya an envelope and said, a?You’ve already been offered!a? Latoya grabbed the envelope and observed the man rush to an old, beat-up Ford Taurus. She pitched the clean, white envelope in to the bushes close to their door and gone in the house. She knew she due a couple of thousand bucks into money shop payday credit businesses in Grafton, and today she had been sued.

Latoya, who expected that the woman final name never be utilized, looked to the payday loan provider when she needed funds to pay their debts. And judging by the amount of this type of functions in Milwaukee, there are numerous more folks just who fall into the same situation.

There are other payday loan providers in Milwaukee as there include McDonald’s diners: 30 payday loan firms inside the urban area restrictions and 25 McDonald’s, based on the business websites. Look into funds, USA payday advance loan andAdvance The united states are a couple of the convenient finances people planted in mainly African-American and Latino communities, where lots of customers in a monetary crisis change once they require revenue.

In accordance with Amy Cantu, director of communications for your people Investment Services Association of America, payday loan contracts promise the lender is within compliance using the fact in Lending operate (TILA), a federal legislation designed to secure customers against unjust credit card and loan methods. TILA does not, however, spot limits how a lot a lender may charge in interest, late costs and other finance costs. The city monetary solutions relationship of The united states shows payday loan providers.

For nearly twenty years, Latoya proceeded to make use of payday lenders to simply help this lady out-of continuous financial hardships. Whenever she necessary to change the timing strip on her 1999 Chevy Malibu, she took

a?At one point, three cash sites had been getting money from my bank account on the other hand,a? mentioned Latoya. a?That’s whenever I understood it absolutely was bad.a?

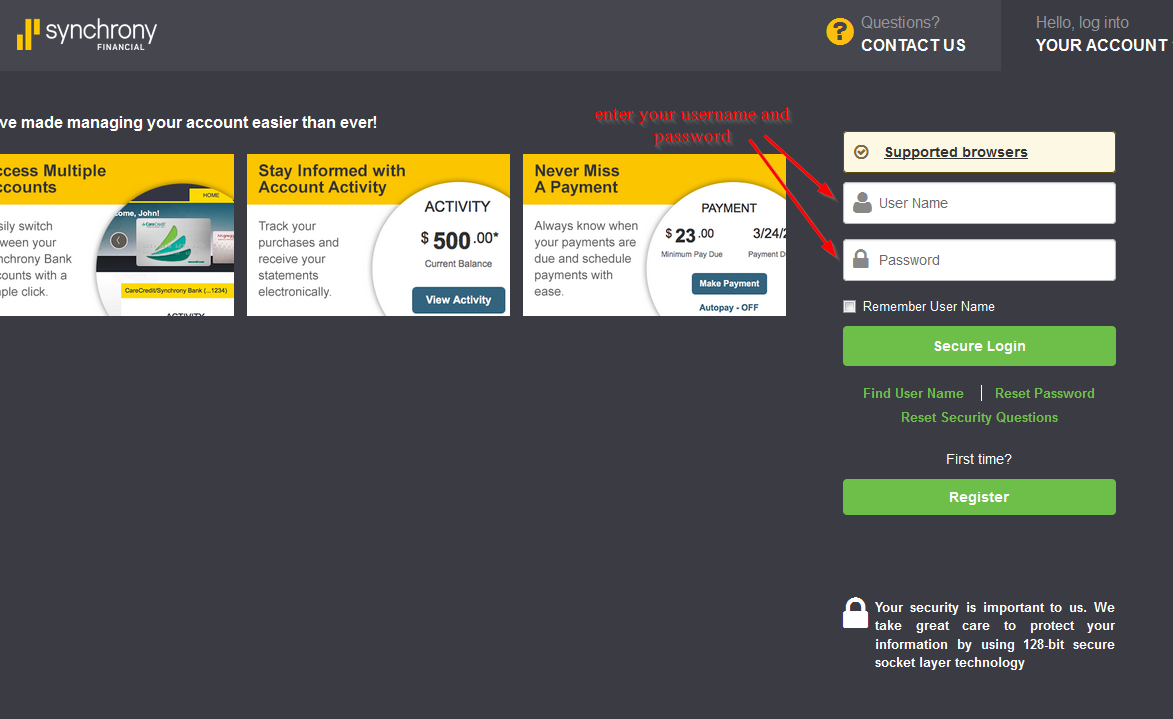

Latoya did not maximum the girl credit to in-store payday loan enterprises; she also utilized on line lenders. Online payday lenders provide the same service as in-store operations, offering an alternative for consumers just who like to submit a loan consult through a web site as opposed to face-to-face.

a?Once i came across the web based shop, I started making use of these solely,a? she said a?we realized online earnings shop energized larger rates, nevertheless the techniques was quicker. I could fax or email my records from the comfort of jobs to get the money 24 hours later or perhaps in some instances, the exact same day.a?

But per a study by Pew charity Trusts, those who borrow cash from web lenders is two times as expected to discover overdrafts to their bank accounts than those whom obtain from a local store. Plus, online-only loan providers usually can eliminate state rules considering that the companies runs completely online.

Per Advance The usa’s Fulmer, a?Much of the adverse stigma associated with this sector is due to the web based loan providers which aren’t controlled during the county level. These lenders function via the Internet, or other overseas location, or even in some cases they’re flat-out swindle performers,a? mentioned Fulmer. a?There’s a big change between those of us who will be managed and audited of the state versus those lenders thatn’t.a?

Payday advances are simpler to secure than a conventional bank loan

In accordance with PNC lender’s internet site, to carry out an unsecured loan, a customer would want https://worldpaydayloans.com/payday-loans-tx/jasper/ evidence of recognition, bank account statements and previous wages stubs. A client’s credit history can impede the borrowed funds, and banks hardly ever making financing funds offered the same day, and/or inside the same day.

Governmental Benefits Tracker

a?we applied for financing from my personal bank and additionally they rejected myself considering my personal debt-to-income ratio. The banker told me they prefer to lend large quantities of cash, repayable eventually,a? mentioned Latoya, that has an energetic checking account with PNC financial. a?My bank could not help me to, how otherwise got we designed to see market and pay my utilities?a?